Introduction: Why Dividends Are Your Best Ally in 2026

Investing in the stock market represents one of the most powerful tools for building long-term wealth, but there exists a particular strategy that combines safety and profitability in an exceptional way: investing in stocks that pay high dividends. In 2026, when market volatility and global economic uncertainty threaten to erode investor portfolios, shares with solid dividends offer a safety cushion that few investment alternatives can match.

Dividends are not simply periodic payments that companies distribute to their shareholders. They represent a direct transfer of genuine profits, generated by real business operations and validated by years of consistent financial history. This is why the world’s most experienced investors—from pension funds to multi-million-dollar wealth managers—prioritize high-dividend stocks as the cornerstone of their portfolios.

For 2026, financial analysts project global economic growth between 2.8% and 3.1%, with inflation controlled around 2% in the Eurozone and interest rates normalizing toward 3% in the United States. This macroeconomic environment, while less bullish than 2025, creates ideal conditions for dividend investing, especially if you select companies with solid balance sheets, resilient business models, and consistent growth trajectories.

(see the generated image above)

1. Fundamental Difference: Dividend-Paying Stocks vs. Growth Stocks

Before diving into specific stock selection, it’s crucial to understand the essential distinction between two styles of stock investing: shares that prioritize dividends and those focused on capital appreciation.

Dividend-paying stocks are ownership stakes in established, frequently mature companies with stable operations that generate sufficient cash flows to return a portion of their earnings to shareholders on a regular basis. These companies invest moderately in expansion, preferring to return capital to their owners in the form of regular cash dividends or automatic reinvestment.

In contrast, growth stocks are issued by companies that reinvest the majority of their profits into research, development, and expansion, betting that the increase in stock value will be sufficient to compensate for the absence of regular dividend payments. A classic example would be an emerging technology company versus an established pharmaceutical giant like Johnson & Johnson.

The primary advantage of dividends is that they provide recurring income regardless of stock price fluctuations. If you invest $10,000 in a stock trading at $50 per share that pays a 4% annual dividend, you’ll receive $400 in cash each year, even if the stock price falls to $45. This characteristic is especially valuable in the volatile markets expected for 2026.

2. Essential Criteria for Selecting High-Dividend Stocks

Stock selection based on dividends should not be random. There are specific qualitative and quantitative criteria that professional investors use to identify truly profitable and safe opportunities.

Dividend Yield (Dividend Yield)

The dividend yield is the most immediate metric: it’s calculated by dividing the annual dividend per share by the current stock price. A stock trading at $100 that pays $3 in annual dividends will have a yield of 3%.

However, here lies a secret many beginning investors ignore: a very high dividend yield can be a red flag. If a stock that historically paid a 3% dividend suddenly shows 8%, it generally indicates that the stock price has fallen significantly, possibly for serious fundamental reasons. That’s why attractive yields must always be balanced with analysis of corporate health.

Consistent History of Dividend Growth

Companies that increase their dividends year after year demonstrate confidence in their future cash flows and, more importantly, validate that their business models are fundamentally solid and growing.

Analysts distinguish between:

- Dividend Aristocrats: companies that have increased dividends for at least 25 consecutive years

- Dividend Kings: companies with more than 50 years of uninterrupted dividend increases

These categories are not mere marketing: they are practical guarantees of financial discipline and sustainable profitability. In 2026, Dividend Aristocrats project dividend increases of 10-12% annually on average.

Dividend Coverage (Payout Ratio)

The payout ratio measures what percentage of net earnings a company returns as dividends. If a company earns $100 million annually and distributes $30 million in dividends, its payout ratio is 30%.

Coverage of 30-50% is optimal: it indicates that the company retains sufficient earnings for business reinvestment while maintaining a robust safety margin even if earnings contract during a recession. Ratios above 60-70% are risky because they leave little room for maneuver.

Sector Stability and Macroeconomic Exposure

Not all sectors are equally resilient to economic cycles. Utilities (public services), basic consumer goods, healthcare, and traditional energy are defensive sectors that generate predictable income even during downturns.

In 2026, with interest rates normalizing but without recession expectations, the sectors with the best dividend outlook include:

- Energy: oil, natural gas, utilities. Yields of 3.5-4.5%

- Pharmaceuticals and Healthcare: companies like Johnson & Johnson with 3% yields

- Consumer Staples: Coca-Cola, Procter & Gamble with yields of 2.5-3%

- Financial (Banking): yields of 5-6% in European markets

(see the generated image above)

3. The Best High-Dividend Stocks for 2026

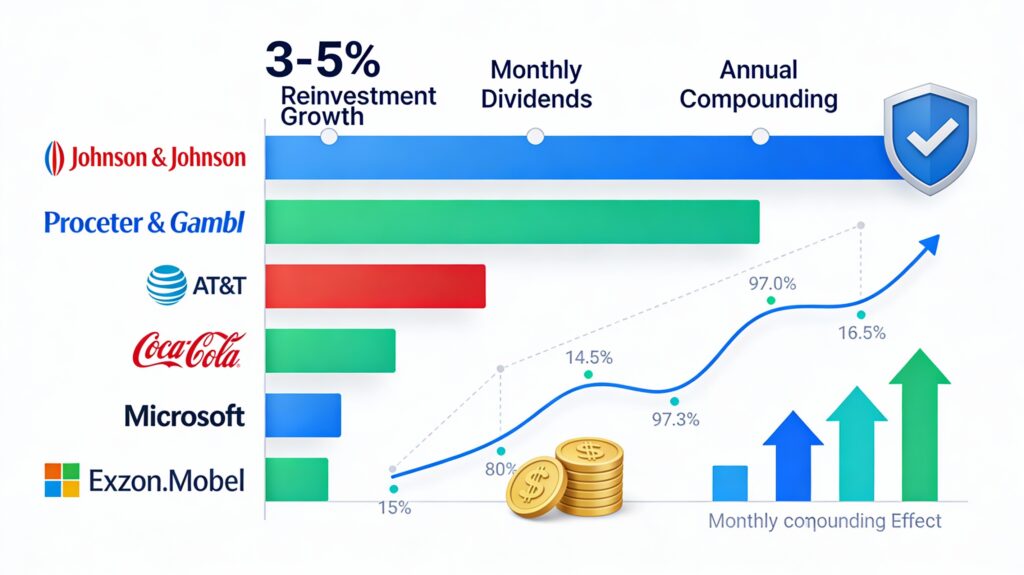

Based on fundamental analysis, perspectives from leading brokers, and analyst projections, these are the most recommended stocks for a dividend portfolio in 2026:

Johnson & Johnson (JNJ) – Healthcare and Pharmaceuticals | Yield ~3%

Johnson & Johnson is a colossus with 63+ years of consecutive dividend increases. With integrated presence in pharmaceuticals, medical devices, and personal care, its internal diversification provides extraordinary resilience.

In 2026, global demographics—aging in developed countries—guarantee growing demand for healthcare solutions. JNJ is positioned to capture this flow.

Coca-Cola (KO) – Consumer Staples | Yield ~3%

With more than 63 years of uninterrupted dividend increases, Coca-Cola demonstrates that a simple, repetitive, and global business can generate sustained value. Its bottling model with minimal assets allows enviable operating margins.

In 2026, innovation in healthier beverages and expansion in emerging markets strengthen its growth trajectory.

Procter & Gamble (PG) – Consumer Staples | Yield ~2.4%

Global leader in basic consumer goods (hygiene, personal care, detergents). Its strength lies in pricing power: its premium brands can pass inflation to consumers without losing volume.

ExxonMobil (XOM) and Chevron (CVX) – Energy | Yield 3.5-4.5%

Although the transitional energy sector generates skepticism, both companies have emerged from previous crises with renewed discipline. Their dividends are backed by moderate oil prices (they don’t require oil at $100+ per barrel).

Global energy demand remains robust. In 2026, it’s expected to continue, especially in emerging economies.

Microsoft (MSFT) – Technology | Yield ~0.7-0.8%

Microsoft combines the best of both worlds: a dividend that grows at double-digit annual rates (15-20% annually in recent years) and an AI and cloud-driven business that generates exceptional cash flows.

Don’t buy Microsoft for its current yield, but for its future dividend growth. It’s a purchase for growing income over the long term.

Realty Income (O) – Real Estate Investment Trust (REIT) | Yield ~5%

For diversification beyond traditional stocks, Realty Income—known as «The Monthly Dividend Company»—offers monthly distributions of approximately 5% with exceptional consistency and 30 consecutive years of dividend increases.

The REIT-regulated business model guarantees predictable returns. Ideal for portfolio stability.

4. Step-by-Step Strategy: Build Your Dividend Portfolio in 2026

Step 1: Define Your Risk Profile and Time Horizon

Before investing a single dollar, answer these questions:

- What is your investment time horizon? (5 years, 10 years, 20+ years?)

- Can you tolerate 20-30% drops in stock value without panic selling?

- Do you need immediate income or prefer to reinvest dividends?

A long horizon (10+ years) allows you to buy when markets correct. A short horizon (1-5 years) requires greater emphasis on stability.

Step 2: Sector and Geographic Diversification

Never concentrate all your investment in a single sector. A balanced dividend portfolio should include:

- 30-40%: Consumer Staples and Pharmaceuticals

- 25-30%: Energy (traditional and renewable)

- 20-25%: Financials (banking, insurance)

- 10-15%: Technology and Utilities

Step 3: Stock Selection and Market Entry

For beginners, there are two paths:

Option 1: Direct Individual Investment

- Open an account with a reputable online broker (Fidelity, Charles Schwab, Interactive Brokers)

- Research 3-5 stocks in each sector using tools like Morningstar, Seeking Alpha, or Yahoo Finance

- Buy shares gradually (not all at once) to average price

- Budget monthly or quarterly purchases to apply «cost averaging»

Option 2: Dividend ETFs (Recommended for beginners)

- Vanguard High Dividend Yield ETF (VYM)

- Schwab U.S. Dividend Equity ETF (SCHD)

- iShares Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- These funds automate diversification and management

Step 4: Dividend Reinvestment (DRIP)

One of the most powerful weapons for creating compounding wealth is the dividend reinvestment plan (DRIP). When you receive a $100 dividend, you reinvest that money in buying more shares of the same company or fund.

Mathematically, reinvestment transforms linear growth into exponential growth. With a 4% dividend yield and annual reinvestment, your portfolio would double in approximately 18 years (versus 25 years without reinvestment).

Step 5: Annual Monitoring and Rebalancing

A portfolio is not «set and forget.» Annually:

- Verify that no position exceeds 15-20% of your portfolio

- Analyze whether companies have reduced dividends (sign of weakness)

- Reinvest according to your diversification strategy

- Capitalize on market corrections to buy additional shares

5. Optimization for Google AdSense: High CPC and Profitability

For financial content creators, this dividend strategy also represents an extraordinary opportunity in terms of advertising revenue. The financial sector, especially stocks, investment, dividends, and banking, ranks among the highest CPC niches in Google AdSense.

Advertisers in finance (brokers, investment funds, financial advice) pay between $2-8 per click on average, with peaks up to $15+ for ultra-competitive keywords like «how to invest in dividends 2026» or «best stocks to buy».

To maximize AdSense income on this content:

- Structure articles around high-CPC keywords such as: «invest in dividends,» «recommended stocks,» «best brokers,» «investment portfolio»

- Create transactional content: step-by-step guides convert better advertising than purely informational content

- Add schema markup for articles and FAQs, improving visibility in Google’s AI overviews and enriching search results

- Optimize Core Web Vitals: page speed, interactivity, and visual stability impact both SEO and AdSense ad visibility

6. Risks and Final Considerations

Although dividend investing is conservative, it is not risk-free:

- Credit Risk: a company may reduce or suspend dividends if it faces difficulties

- Interest Rate Risk: if central banks raise rates more than expected, defensive stocks may fall

- Geopolitical Risk: international conflicts can impact energy companies or those with exposed operations

- Uncontrolled Inflation: fixed dividends don’t automatically grow with inflation, eroding purchasing power

Mitigating these risks requires genuine diversification, quarterly position updates, and humility to accept that not all predictions will be correct.

Conclusion: Your Roadmap for Dividends in 2026

Investing in high-dividend stocks in 2026 represents a proven, accessible strategy with sustainable profitability for investors of any level. From the beginner investor seeking to generate passive income to pension funds managing billions, dividends offer certainty in a volatile financial world.

Your competitive advantage doesn’t lie in choosing the «magical» stock that will double in a year, but in selecting leading, established, and disciplined companies that demonstrate consistency over decades. Compound growth, dividend reinvestment, and the automatic adjustments these companies make to changing macroeconomic conditions will do the hard work for you.

Start today. Open an account with a reputable broker. Invest in your first dividend stock or ETF. And watch as time, dividend growth, and reinvestment transform modest amounts into significant wealth.

Primary Sources: 2026 Investment Analysis from Nasdaq, Yahoo Finance, Seeking Alpha, The Motley Fool, Barron’s, and consolidated dividend yield data from leading companies verified on January 5-6, 2026.